Monetary Theory and Policy (Eco 403)

Monetary Theory and Policy (Eco 403)

First homework solutions are up. See below.

First homework grades are up. click HERE.

Course Description

Monetary Economics is concerned with the effects of monetary institutions (such as the Federal Reserve Bank) and policy

actions on economic variables (such as inflation and interest rates) that are of importance to individuals and

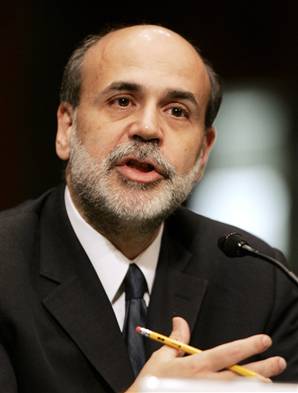

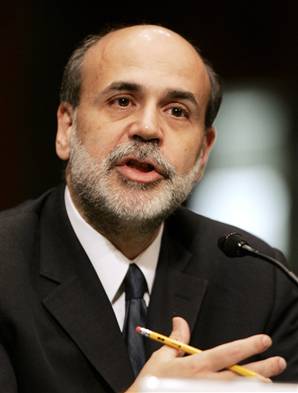

firms. Monetary Policy is considered by many to be of critical importance to the economy. Indeed, Ben Bernanke, the

chair of the Federal Reserve Bank, is often called the second most powerful man in the United States. The Federal

Reserve is playing a critical role in the government's respose to the current credit crises.

The class will consist of three parts. In the first part, we will study money and related variables such as inflation

and interest rates. This includes study of the banking system and various institutions such as the Federal Reserve. The

second part of the course examines monetary policy. Once we understand the relationships between money, interest rates,

and inflation, we can ask what the optimal interest rate policy is, and how to implement it. The third part of the

course examines interesting monetary episodes in the US and across the world. Recent hyperinflation in Russia and Brazil

is quite similar to events in the US during the civil war and in Europe after WWI. Is there a common source of

inflation? Credit crises also occur on occaision in the U.S. and elsewhere. How should the government respond to credit

crises?

General Information

Professor: Associate Professor Dr. David L. Kelly (Dave).

Course Meetings:

Mondays and Wednesdays from 12:20 to 1:35 pm in room SB 308.

Office: Room 521B, Jenkins School of Business.

Office hours: Tuesdays at 2-3 pm (Dave is almost always around during business hours, but try to come

during office hours if you can).

Contacts: Dave can be contacted via phone (8x3725) or email (dkelly@miami.edu).

Web Site:

Dave has established a website (http://moya.bus.miami.edu/~dkelly/teach/eco403/eco403.html)

for this course. At this site, you can download or view course material (homeworks, etc.), as well as a continuously

updated syllabus.

Final Exam:

Wednesday, May 5 from 2 pm to 4:30 pm (Section EF).

Prerequisites

This course requires Eco 212 (Principles of Macroeconomics).

Textbooks

The class follows the lecture notes, which are available on the website. However, some parts follow the following

textbook, which is optional.

Dean Croushore, Money and Banking: A Policy Oriented Approach Houghton Mifflin Company, Boston, MA, 2007.

A few sections follow this book (again optional):

Bennett T. McCallum, Monetary Economics: Theory and Policy. Macmillan Publishing, NY, 1989.

Grades

3 Homeworks (Feburary 10, March 24, and April 21) 25%

First Challenge (Quiz): Wednesday February 24, 25%

Second Challenge (Quiz): Wednesday April 7, 25%

Final Challenge (Quiz): Wednesday May 5, 25%

You can now access your grades on line HERE!

Additional Notes

- Attendance is very important for this class. All exam material comes from class notes, and not all class notes

are available in the book. Dave tries to reference every topic (whether in the book or elsewhere). However, the wily

student usually aces the course by attending every class and taking careful notes.

- The two quizzes are Wednesday, February 24 and Wednesday April 7. Now is the time to mark your calendars.

Only in the most dire emergencies can the student not take a quiz at the scheduled time. Even in dire emergencies,

Dave does not allow a make-up, but instead counts the next quiz or final double. STUDENTS MUST LET DAVE KNOW OF THEIR

DIRE EMERGENCY BEFORE THE QUIZ BEGINS OR ELSE A ZERO IS AUTOMATICALLY RECORDED.

- Homeworks are due in class, at the beginning of class. Showing up 20 minutes late because you didn't finish the

homework on time is not acceptable. Putting a homework in my mailbox, under my door, etc. is also not acceptable.

Emailing homework is only acceptable if done in advance. Only in the most dire emergencies can a student be excused from

turning in a homework on time. Even in dire emergencies Dave does not allow the homework to be turned in late, but will

instead weight the final more. Students must let Dave know of their dire emergency before the beginning of the class for

which the homework is due or else a zero is automatically recorded.

Some Macro Links and Career Information

The history of the fifty. Check out this link to get an idea about the course.

Course Outline

DC is the Dean Croushore book and BM is the the Bennett McCallum book.

- Introduction (BM:1, January 20 - February 3).

- Facts about the Monetary Economy (DC:1).

- Money (BM:2, DC:3,8,15, DC:461-488)

- Functions of Money (DC:3)

- Measures of Money

- Fiat vs. Commodity Money

- The Banking System (DC:8)

- The Federal Reserve (DC:15)

- Inflation

- Interest Rates (DC:p110-118,150-159)

- HOMEWORK 1, DUE FEBRUARY 10

- The Money Market (February 10-22)

- Money Supply (BM:4.1-4.4, DC:p461-488)

- Money Demand (BM:3.1)

- Baumol-Tobin Model (BM:3.6, DC:307-315)

- Cagan Model (BM:7.1)

- FIRST QUIZ FEBRUARY 24

- Velocity (BM:3.5)

- The Inflation Tax (article, February 24- March 3)

- Seniorage

- Welfare costs of the inflation tax

- Budget Deficits and Inflation

- Laffer Curve of Inflation Tax

- Classical and Keynesian Models (BM:5, DC:12, March 8-24)

- Aggregate Demand (BM:5.1-5.4)

- Classical Aggregate Supply (BM:5.5)

- Keynesian Aggregate Supply (BM:5.7, 5.8)

- Neutrality and Policy in the Classical Model (BM:5.6)

- HOMEWORK 2, DUE MARCH 24

- Policy and policy effectiveness in the Keynesian Model (BM:5.8)

- Phillips Curve (March 24-March 31)

- Classical and Keynesian (BM:9.2, DC:512-516)

- Lucas Monetary Misperceptions (BM:9.4, DC:516-520)

- SECOND QUIZ, APRIL 7

- Monetary Policy Implementation (April 7-21)

- Policy Rules vs. Discretion (BM:12,11.3, DC:p494-512, DC:18)

- Targeting

- Interest Rate Targeting (BM:4.4)

- Money Supply Targeting (BM:4.3)

- Exchange Rate Targeting (BM:14.5-14.7)

- Inflation Rate targeting (including asset price inflation, articles)

- HOMEWORK 3, DUE APRIL 21

- Commodity Standards (BM:13)

- Interesting Monetary Episodes (April 25-28)

- Recent episodes: Federal Reserve and the credit crises (articles)

Class Handouts

Note: all handouts may be downloaded as Adobe Acrobat pdf files. If your computer cannot read acrobat files, download

the reader for free HERE .

Homework 1, Due Wednesday February 10.

Homework 1, Solutions.

Notes, graphs, tables, etc.

Below are some notes for the class. I will add notes periodically throughout the semester. You will see that these

notes, while helpful, are in an outline format and do not substitute for the notes taken in class.

Notes: Introduction (Section I)

Notes: Money Market and Inflation Tax (Section II, III)

NOTE: Below is corrected version of notes for classical/Keynes. Corrects typos in graphs classical monetary policy

(section IV A) and Keynes monetary policy (section IV B).

Notes: Classical Model (Section IV)

Notes: Phillips Curve (Section V)

Notes: Monetary Policy Implementation (Section VI)

Velocity in the United States

Velocity in some high inflation economies

Liquidity Trap

Up to Dave Kelly's homepage

Macroeconomics Links

Careers in Economics